By October 9, $850

After October 9, $1,050

(Sunday night’s opening reception at The Bygone and Monday night's dinner at the Four Seasons, and lunch and breakfast on Monday and Tuesday are included with registration.)

First registrant from company pays full price. Additional registrants from same company each receive $100 discount. There is no discount for additional registrants from same company with virtual option.

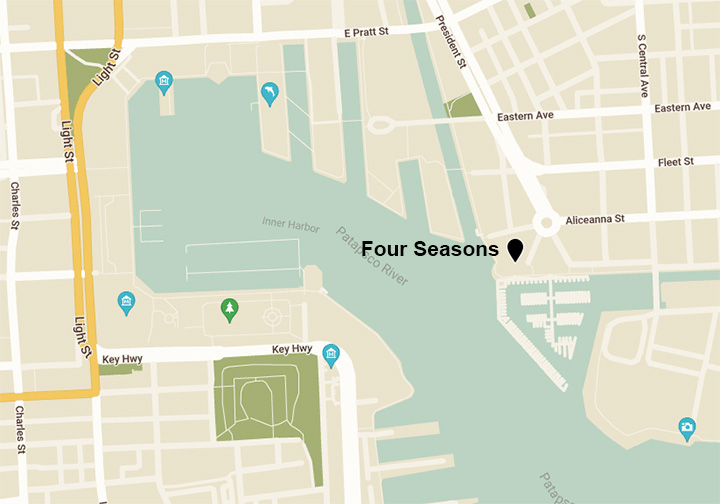

Four Seasons Hotel in Baltimore

200 International Drive, Baltimore, MD 21202.

Following registration, attendees are invited to reserve accommodations at the special conference rate of $279 per night. The hotel booking link will be provided once registration is confirmed.

Draft Agenda Coming Soon

Join Us for the 22nd Annual Financial Services Conference

November 8–10, 2026 | Four Seasons Hotel Baltimore

We’re excited to welcome you back to the Four Seasons Hotel Baltimore, the Inner Harbor’s premier hotel, for the 22nd Annual Hudson Cook / CounselorLibrary Financial Services Conference.

Designed exclusively for the financial services industry (no reporters or consumer advocates), the conference brings together compliance, legal, and business leaders for in-depth discussions on consumer and commercial finance, regulatory compliance, and privacy and data security.

For more than two decades, Hudson Cook and CounselorLibrary have helped clients and subscribers navigate complex, multistate regulatory landscapes. In 2026, our attorney-led sessions will again focus on state and federal regulatory developments, enforcement trends, and private litigation issues, delivering practical insights you can apply immediately.

What to expect:

Bring your compliance team, legal department, and business leaders for three days of learning, conversation, and connection.

We look forward to seeing you in Baltimore.

* * * *

DISCLAIMER

Legal Information Is Not Legal Advice

The panel discussions and presentations at our conference are not legal advice, and attendance at our presentations does not create an attorney-client relationship with Hudson Cook, LLP. Our goal is to provide accurate and authoritative information regarding the subject matters we cover at the conference. You should not rely on the information in our conference as legal advice with respect to any particular transaction. If you need additional information or assistance in interpreting the application of state or federal law to a specific transaction or circumstance, or definitive confirmation as to the current content and status of the law, you must consult legal counsel.

Your sponsorship includes complimentary event registrations, ads in Spot Delivery®, exhibit space, and more.

Contact:

Bryan Lawson

410.782.2357

blawson@hudco.com

* * * *